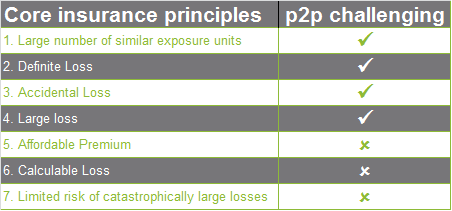

p2p Insurance is redefining the way we see insurance. Take for example the 7 common characteristics of insurable risks. These 7 principles are often quoted as the core foundations of insurance - p2p is shaking that core:

1. Large number of similar exposure units

p2p insurance works on a small number of similar exposure units peers. p2p insurance benefits from peer networks reducing agency problems like fraud and exaggeration of claim amounts.

2. Definite Loss

Most insurance policies are a named peril cover i.e. only defined risks are covered. But this fails to cover unknown risks i.e. what is left over, after you think you've thought of everything. p2p insurance is taking a broader view of risk - in some cases looking to define risk after it has happened.

3. Accidental Loss

Whilst it makes sense that only fortuitous events should be covered or at least those events outside the control of the beneficiary of the insurance, when you look at the real world it is not so black and white. For instance, is divorce fortuitous - HK p2pInsurer Tong Ju Bao thinks not.

4. Large loss

Insurers have concentrated on insuring the big ticket items because the frictional cost of insurance (capital, regulation, policy administration etc) making insuring the small stuff uneconomical. The internet and cell phones has changed all of that - many frictional costs are no more. We are seeing a few areas challenging this principle, micro-insurance is just one.

5. Affordable Premium

If the premium is large relative to the amount of protection offered, then why buy insurance. I think this applies to p2pInsurance as well.

6. Calculable Loss

This covers off whether a reasonable estimate can be made as to the frequency and severity of losses. It speaks to whether insurance can be equitable i.e. premiums are fair and whether a reasonable claim amount can be determined. The calculation doesn't have to be exact but should be close enough - I think p2pInsurer's simple rules cover this.

7. Limited risk of catastrophically large losses

This is in-built into p2p Insurance because no matter what happens the maximum peers can be paid is what is in the pool.

So, p2p is challenging 4 of the 7 core insurance principles. Not bad for a new starter.

p2p insurance works on a small number of similar exposure units peers. p2p insurance benefits from peer networks reducing agency problems like fraud and exaggeration of claim amounts.

2. Definite Loss

Most insurance policies are a named peril cover i.e. only defined risks are covered. But this fails to cover unknown risks i.e. what is left over, after you think you've thought of everything. p2p insurance is taking a broader view of risk - in some cases looking to define risk after it has happened.

3. Accidental Loss

Whilst it makes sense that only fortuitous events should be covered or at least those events outside the control of the beneficiary of the insurance, when you look at the real world it is not so black and white. For instance, is divorce fortuitous - HK p2pInsurer Tong Ju Bao thinks not.

4. Large loss

Insurers have concentrated on insuring the big ticket items because the frictional cost of insurance (capital, regulation, policy administration etc) making insuring the small stuff uneconomical. The internet and cell phones has changed all of that - many frictional costs are no more. We are seeing a few areas challenging this principle, micro-insurance is just one.

5. Affordable Premium

If the premium is large relative to the amount of protection offered, then why buy insurance. I think this applies to p2pInsurance as well.

6. Calculable Loss

This covers off whether a reasonable estimate can be made as to the frequency and severity of losses. It speaks to whether insurance can be equitable i.e. premiums are fair and whether a reasonable claim amount can be determined. The calculation doesn't have to be exact but should be close enough - I think p2pInsurer's simple rules cover this.

7. Limited risk of catastrophically large losses

This is in-built into p2p Insurance because no matter what happens the maximum peers can be paid is what is in the pool.

So, p2p is challenging 4 of the 7 core insurance principles. Not bad for a new starter.