- Primarily for medical costs

- Members commit to pay a certain amount each month towards any medical expenses that members in their group may have.

- The cost sharing organizations streamline members' donations and make sure they make it to other members who are in need that month.

- Members are generally required to examine costs prior to making health care decisions which keeps costs low.

- Because this is not insurance, there is no guarantee that medical bills will be paid.

- There are rules or guidelines that provide for what types of expenses the membership will share and what types are not approved for sharing.

- The member base is sufficiently large that the fact that there is no guarantee is largely legal semantics.

- Members who have common ethical or religious beliefs

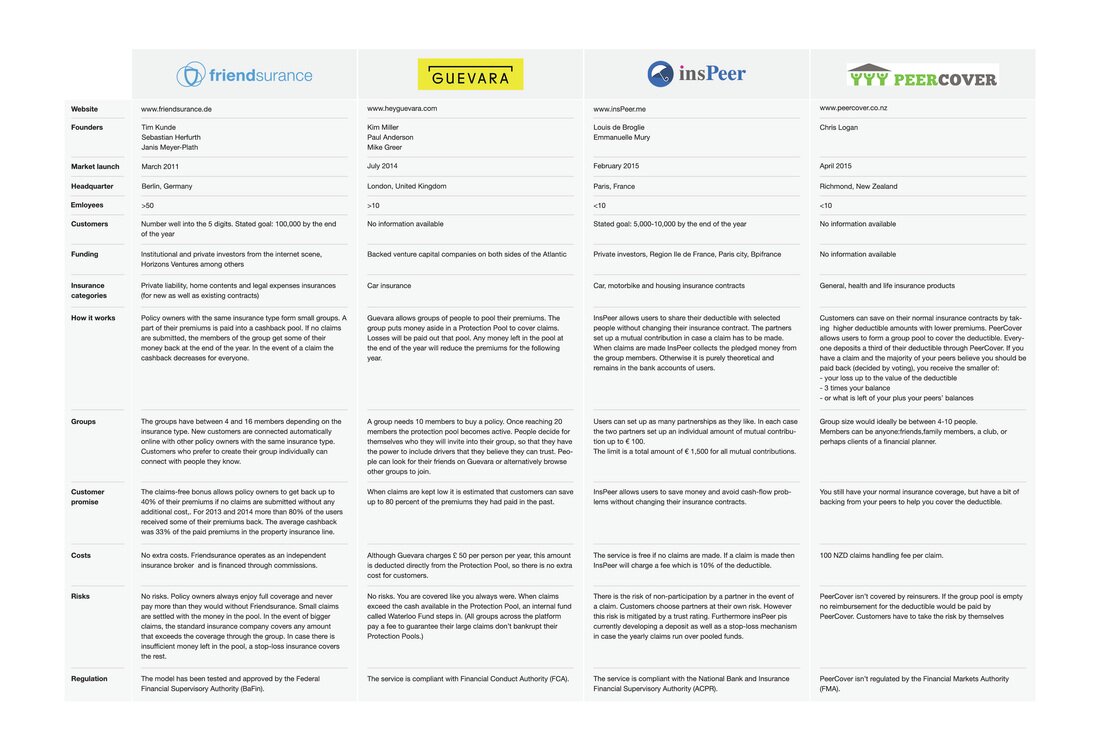

But what about 'P2P Insurance'^ like PeerCover:

-

Primarily for car insurance but able to be adapted to other risks (pet, phone, health, house etc)

-

Members deposit monies which may pay for costs that members in their group may have

-

PeerCover streamline members' deposits and payment to other members who have claims

- Members are expected to only claim for reasonable expenses as the group can vote down the payment (by majority only)

- There is no guarantee that claims will be paid

- There are rules around the maximum payment*

- The member base is small but so are the risks taken (insurance excess or gaps in insurance cover) so the fact that there is no guarantee is not a big issue

- Members who have common beliefs i.e. transparency will lead to better outcomes, no claim means no costs, fairness over fine print

^ P2P Insurance has different interpretations, some have no deposits but can call on members to fund losses, others use insurers to redistribute premium - not just to pay claims, expenses and profit but also to pay claims experience discounts.

* the smaller of member net loss after insurance, 3x the members deposit, the total of the PeerGroup deposits less the $100 claims administration fee