Relying on koha to 100% fund the tangihanga may be possible, but in many cases it is not. Unexpected tangihanga costs can put your whanau under financial stress as costs can easily exceed $10,000. For instance:

- The average cost of a funeral is between $6500 and $7000

- Cost of repatriation from Brisbane is between $6,500 -$8.500

- Food costs $66+ per person per day

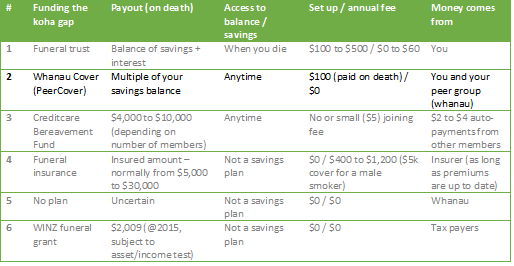

There are various ways to fund the koha gap - here are 6 ways:

Insurance companies marketing might want you to believe Funeral Insurance (3) is the next best option, however you need to consider some caveats:

- It may take two year before you get full cover (death from illness, disease or suicide may be not be covered initially)

- If your can't pay your premiums, you may be left with nothing

- Premiums get used up by: insurance profits, insurance expenses (marketing etc) and paying other claims (likely to people you don't know)

You may want to consider other options...

If you are a member of a credit union such as ACU or NZCU you can opt-in to their bereavement fund (3). If any member of the fund dies, a small automatic payment (ranges from $2 to $4) is made from all other member. Depending on the number of fund members, the payout can be anywhere from $4,000 to $10,000.

If you want to be a bit more exclusive (bereavement fund membership is normally in the thousands) then you may want to consider Whanau cover (PeerCover). Like a bereavement fund:

-

There is no initial period where cover is limited

- You can take your money out whenever you want

-

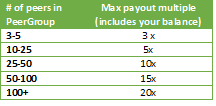

The payout is based on a multiple of your balance* where the cost is shared pro-rata from others in your PeerGroup (whanau).

- There are no annual fees (or interest) just a $100 fee paid upon death, the rest of the money goes to you and your PeerGroup

- You can see who else is in your PeerGroup and their balances - it is not anonymous. Importantly you will be notified of any claim, so you know where your money is going.

-

PeerGroup members can, by majority, not accept new members or decline payouts (effectively reducing the payout multiple to 1)

* recommended multiples are:

If you are interested in Whanau Cover for your iwi, hapu, whanau or just friends - join up today.